Cayman Islands

2008/9 Schools Wikipedia Selection. Related subjects: Americas; Countries

| Cayman Islands | ||||||

|---|---|---|---|---|---|---|

|

||||||

| Motto: "He hath founded it upon the seas" | ||||||

| Anthem: God Save the Queen |

||||||

|

|

||||||

| Capital (and largest city) |

George Town |

|||||

| Official languages | English | |||||

| Demonym | Caymanian | |||||

| Government | British Overseas Territory | |||||

| - | Queen | Queen Elizabeth II | ||||

| - | Governor | Stuart Jack | ||||

| - | Leader of Government Business |

Kurt Tibbetts |

||||

| Creation | ||||||

| - | Split from Jamaica | 1962 | ||||

| Area | ||||||

| - | Total | 260 km² ( 207th) 100.4 sq mi |

||||

| - | Water (%) | 1.6 | ||||

| Population | ||||||

| - | 2005 estimate | 45,017 ( 208th) | ||||

| - | 1999 census | 0 | ||||

| - | Density | 139.5/km² ( 63rd) 364.2/sq mi |

||||

| HDI (2003) | n/a (NA) ( unranked) | |||||

| Currency | Cayman Islands dollar ( KYD) |

|||||

| Time zone | ( UTC-5) | |||||

| - | Summer ( DST) | not observed ( UTC-5) | ||||

| Internet TLD | .ky | |||||

| Calling code | +1 345 | |||||

The Cayman Islands are a British overseas territory located in the western Caribbean Sea, comprising the islands of Grand Cayman, Cayman Brac, and Little Cayman. It is a tax haven financial centre and one of the many scuba diving destinations in the Caribbean.

History

The Cayman Islands were first sighted by European eyes when Christopher Columbus, on 10 May 1503, encountered them during his disastrous fourth and final voyage to the New World. He named them Las Tortugas after the numerous sea turtles there. The first recorded English visitor to the islands was Sir Francis Drake, who landed there in 1586 and named them the Cayman Islands after the Neo-Taino nations term ( caiman) for crocodile (Zayas, 1914).

The first recorded permanent inhabitant of the Cayman Islands, Isaac Bodden, was born on Grand Cayman around 1700. He was the grandson of the original settler named Bodden who was probably one of Oliver Cromwell's soldiers at the taking of Jamaica in 1655.

The islands, along with nearby Jamaica, were captured, then ceded to England in 1670 under the Treaty of Madrid. They were governed as a single colony with Jamaica until 1962 when they became a separate British Overseas Territory and Jamaica became an independent Commonwealth realm.

The largely unprotected at sea level island of Grand Cayman was hit by Hurricane Ivan on 11- 12 September 2004, which destroyed many buildings and damaged 70% of them. Power, water and communications were all disrupted in some areas for months as Ivan was the worst hurricane to hit the islands in 86 years. However, Grand Cayman forced a major rebuilding process and within two years its infrastructure was nearly returned to pre-Ivan levels. The Cayman Islands have the dubious honour of having experienced the most hurricane strikes in history. Due to the proximity of the islands, more hurricane and tropical systems have affected the Cayman Islands than any other region in the Atlantic basin (brushed or hit every 2.23 years). The Cayman Islands enjoy a high global standard of living fully dependent upon tourism and tax-haven dependent banking.

Geography

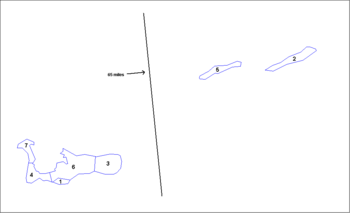

The Cayman Islands are located in the western Caribbean Sea. They are the peaks of a massive underwater ridge, known as the Cayman Trench, standing 8,000 feet (2,400 m) from the sea floor, which barely exceeds the surface. The islands lie in the centre of the Caribbean south of Cuba and West of Jamaica. They are situated about 400 miles (650 km) south of Miami, 180 miles (300 km) south of Cuba, and 195 miles (315 km) northwest of Jamaica. Grand Cayman is by far the biggest, with an area of 76 square miles (197 km²). The two "Sister Islands" of Cayman Brac and Little Cayman are located about 80 miles (130 km) east of Grand Cayman and have areas of 14 square miles (36 km²) and 10 square miles (25.9 km²) respectively.

All three islands were formed by large coral heads covering submerged ice age peaks of western extensions of the Cuban Sierra Maestra range and are mostly flat. One notable exception to this is The Bluff on Cayman Brac's eastern part, which rises to 140 feet (42.6 m) above sea level, the highest point on the island.

Cayman avian fauna includes two endemic subspecies of Amazona parrots: Amazona leucocephala hesterna, or Cayman Brac Parrot, native only to Cayman Brac, and Amazona leucocephala caymanensis or Grand Cayman Parrot, which is native only to Grand Cayman. Another notable fauna is the endangered Blue Iguana, which is native to Grand Cayman. There is also the agouti and the Booby Birds on Cayman Brac.

Districts

Administratively, The Cayman Islands are divided into seven districts:

- Bodden Town (the former capital)

- Cayman Brac

- East End

- George Town (the present capital)

- Little Cayman

- North Side

- West Bay

Demographics

The Cayman Islands have more registered businesses than it has people. The latest population estimate of the Cayman Islands is about 50,000 as of July 2006, representing a mix of more than 100 nationalities. Out of that number, about half are of Caymanian descent. About 60% of the population is of mixed race (mostly mixed African-European). Of the remaining 40%, about half are of European descent and half are of African descent. The islands are almost exclusively Christian, with large number of Presbyterians and Catholics. Caymanians enjoy one of the highest standards of living in the Caribbean. The vast majority of the population resides on Grand Cayman. Cayman Brac is the second most populated with about 1,200 residents, followed by Little Cayman with around 200 permanent residents.

Many of the prominent and wealthy families in Grand Cayman such as the Waltons, Scotts, Kirkconnells, and Fosters are originally from Cayman Brac. They control a large proportion of real estate property and business enterprises, along with having significant positions in the financial sector.

The capital and major city of the Cayman Islands is George Town, which is located on the south west coast of Grand Cayman.

Economy

The economy of the Cayman Islands was once centred around turtling. However, this industry began to disappear in the twentieth century and tourism and financial services began to become the economic mainstays during the 1970s. The United States is the Cayman Islands' largest trading partner.

With an average income of around $42,000, Caymanians enjoy the highest standard of living in the Caribbean. According to the CIA World Factbook, the Cayman Islands GDP per capita is the 12th highest in the world. The islands print their own currency, the Cayman Islands Dollar (KYD), which is pegged to the U.S. dollar at a fixed rate of 1 KYD = 1.2 USD.

The government's primary source of income is indirect taxation. An import duty of 5% to 20% is levied against goods imported into the islands. Few goods are exempt; notable examples include books, cameras and infant formula. The government charges licensing fees to financial institutions that operate in the islands as well as work permit fees for expatriate employees ranging from around US$500 for a clerk to around US$20,000 for a CEO.

Tourism

Tourism accounts for 70-75% of the annual GDP of the Cayman Islands. Of the millions of tourists that visit the islands annually, 99% visit Grand Cayman. George Town also serves as a major cruise ship port, which brings in 4,000 to 22,000 tourists a day, five days a week, depending on the number of ships in port.

One of Grand Cayman's (GCM) main attractions is the world-famous Seven Mile Beach on which a number of the island's hotels and resorts are located. Seven Mile Beach is regarded by many as one of the best beaches in the world. Historical sites in GCM such as Pedro St. James Castle in BoddenTown also attract visitors. The Sister Islands - Little Cayman and Cayman Brac - also supply their own unique charm.

The Cayman Islands is regarded as one of the world's best SCUBA diving destinations because of its crystal-clear waters and pristine walls. Cayman Brac and Little Cayman are also elite SCUBA dive destinations. There are several snorkelling locations where tourists can swim with stingrays including the popular Stingray City, Grand Cayman. Divers find two shipwrecks off the shores of Cayman Brac particularly interesting including the MV Keith Tibbetts.

Other Grand Cayman tourist attractions include the Ironshore landscape of Hell, the 24- acre marine theme park Boatswain's Beach, also home of the Cayman Turtle Farm, the production of gourmet sea salt, and the Mastic Trail, a hiking trail through the forests in the centre of the island. On Cayman Brac, a lighthouse and a few local museums are tourist draws. Little Cayman's wildlife attracts nature lovers, especially bird watchers in search of the island's Red-footed Booby population.

Art and Culture are other features of the Cayman Islands that attract international attention. The National Museum and National Gallery preserve contemporary and dated art works of local and international talent. A Cultural History Exhibition is displayed within the museum, and teaches patrons about historical customs and traditions native to the Cayman Islands. The Gallery sponsors eight exhibitions every year and is located in the Harbour Place in George Town.

Financial services industry

The Cayman Islands are recognised as a financial services centre.

The Cayman Islands financial services industry encompasses banking, mutual funds, captive insurance, reinsurance, vessel registration, companies and partnerships, trusts, structured finance and the Cayman Islands Stock Exchange. As of December 2005, just over 70,000 companies were incorporated on the Cayman Islands including 430 banking and trust companies, 720 captive insurance firms and more than 7,000 funds. The government distinguishes between local (or "ordinary" companies), doing business primarily with the local population, and "exempted" companies conducting business primarily with overseas entities.

There has been a trend of financial institutions reincorporating in first world countries with better regulation.

A recent report released by the International Monetary Fund (IMF) assessing supervision and regulation in the Cayman Islands' banking, insurance and securities industries, as well as its anti- money laundering regime, recognised the jurisdiction's comprehensive regulatory and compliance frameworks. "An extensive program of legislative, rule and guideline development has introduced an increasingly effective system of regulation, both formalising earlier practices and introducing enhanced procedures," noted IMF assessors. The report further stated that "the supervisory system benefits from a well-developed banking infrastructure with an internationally experienced and qualified workforce as well as experienced lawyers, accountants and auditors," adding that, "the overall compliance culture within Cayman is very strong, including the compliance culture related to AML ( anti-money laundering) obligations...". The Cayman Islands had previously (briefly) appeared on the FATF Blacklist in 2000, although its listing was thought to be harsh, and was criticised at the time.

From http://www.pbs.org/wgbh/pages/frontline/shows/tax/schemes/cayman.html:

"In May 2000, the Cayman Islands avoided the OECD's infamous blacklist by "committing" itself to a string of reforms to improve transparency, remove discriminatory practices, and begin to exchange information with OECD member states about their citizens.

However, with the election of George W. Bush to the U.S. presidency, cooperation between Cayman and the OECD lost momentum. In May 2001, after the U.S. Treasury Department announced that it would not support the OECD initiative, other than pursuing tax exchange agreements, the OECD turned its attention to another initiative, the EU Tax Savings Directive."

"While the... (tax information exchange agreements (TIEA))... somewhat bolster the U.S. government's ability to prosecute corporations and individuals engaging in tax evasion, the agreements are limited, and in most cases do not allow the IRS to investigate suspected corporations or individuals unless there is a court order or strong evidence of criminal activity." As one Cayman official stated, "Despite excellent fishing in the Cayman waters, no fishing expeditions are allowed."

Another obstacle hampering the IRS investigations of tax fraud by U.S. citizens in the Cayman Islands is Cayman's Confidential Relationships Preservations Law (CRPL), which requires banking confidentiality unless there is evidence of criminal activity. While the Cayman government has gone a long way towards enforcing due diligence and the sharing of information with the U.S. government, Cayman's banking privacy laws remain intact. David McConney, CEO of Cayman National Bank, says, "Financial privacy is fundamental to traditional banker/customer relationships. If you have not committed a criminal act, no Cayman financial institution may release any information to any third party without your express approval."

If the IRS wants to investigate potential wrongdoing by a U.S. corporation or individual, it must request information from Cayman's chief justice on a case-by-case basis. Unfortunately, this painstaking process is inadequate to deal with the numerous cases of tax fraud perpetrated by U.S. citizens and corporations. Furthermore, the IRS does not have sufficient resources to pursue investigations of wrongdoing on a case-by-case basis."

From http://www.radiocayman.gov.ky/pls/portal30/docs/FOLDER/MARKETINGANDPROMOTIONS/PRESSRELEASES/2002PRESSRELEASES/ENRON.PDF :

"On 27 November 2001, the Cayman Islands, concluded a tax information exchange agreement with the U.S. The agreement provides for exchange of information, upon request, for criminal tax evasion, civil and administrative tax matters relating to U.S. federal income tax. It provides for confidential treatment of information exchanged, and, in accordance with U.S. law, any such information may not be disclosed to any third party. It applies to criminal tax evasion for taxable periods commencing 1 January 2004, and to all other tax matters for taxable periods commencing 1 January 2006."

From http://www.mondaq.com/article.asp?articleid=21025 :

"OECD commitment

In May 2000 the Cayman Islands gave a letter of commitment to the OECD relating to alleged harmful tax competition. Under the letter of commitment, the Cayman Islands Government will implement a plan to share bank account information with foreign Governments that are conducting criminal tax evasion investigations for the first tax year after 31 December 2003, and on civil and administrative tax matters for the first tax year after 31 December 2005.

Tax information exchange agreement

On 27 November 2001 the Cayman Islands entered into a tax information exchange agreement with the US. The agreement is structured to conform with the Cayman Islands’ OECD commitment of May 2000. The implementation procedure will require that information be provided only in response to a specific request which is relevant to a tax examination or investigation conducted in accordance with the laws of the requesting state. Requests will be submitted by foreign tax authorities to a competent authority in the Cayman Islands who will act in a capacity similar to that in which the Cayman Islands Chief Justice has acted pursuant to other international information exchange agreements. Confidentiality provisions will ensure that information that has been exchanged is adequately protected from unauthorised disclosure.

It is likely that there will be further bilateral tax information exchange agreements. However, the Cayman Islands Government has made it clear that it will not enter into any agreements with countries that have legislation discriminating against the Cayman Islands.

EU Savings Directive

What has become known as the Savings Directive is part of a package of measures by the European Commission to tackle "harmful tax competition" in the European Union. It is designed to address the ability of "residents of Member States …. to avoid any form of taxation in their Member State of residence on interest they receive in another Member State".

The current form of the Savings Directive is a compromise solution following the failure of Member States to agree on the original proposal for the imposition of withholding tax on interest payments (which would have had a serious effect on the Eurobond market in London). In implementation of the requirement that Member States "promote the adoption of the same measures" in their dependent or associated territories, the UK Government has committed its Caribbean dependent territories, including the Cayman Islands, to their adoption and has threatened to "legislate" for them.

The Savings Directive requires the reporting of certain information relating to interest payments (including dividend payments by certain investment vehicles whose investments in debt instruments exceeds a certain percentage) to individuals resident in Member States. That information is to be provided by the paying agent (essentially, the last intermediary in a chain of intermediaries), who is also responsible for determining the residence of the payee.

The Cayman Islands Government is concerned that any application of the Savings Directive to the Islands, without equivalent application to their competitors, will result in little benefit to the European Union at a disproportionate cost to the Islands. The UK Government is aware from its own regulatory impact assessment that implementation of the Savings Directive will result in significant additional costs to both the public and private sectors in the UK, and the same will undoubtedly be true in the Cayman Islands.

The Cayman Islands has declined to commit to the implementation of the measures in the Savings Directive, and is now bringing legal proceedings to challenge the legality of certain aspects of the Savings Directive."

From: http://www.escapeartist.com/OREQ21/Asset_Protection.html

"If you read the press releases from the offshore jurisdictions that signed TIEAs, you’ll come away believing that they may be invoked only in the event of probable cause of tax fraud by a particular taxpayer. But that’s not what most of the treaties actually say. Instead, most TIEAs state that any information “foreseeably relevant or material to United States federal tax administration and enforcement with respect to the person identified” for investigation must be turned over to the IRS.

Not “probable cause” of a criminal or even civil tax offense. Not even “reasonable suspicion.” Merely “foreseeably relevant.” U.S. courts have interpreted this authority as permitting TIEA information requests “even if the United States has no tax interest and no claim for U.S. taxes are potentially due and owing.” In other words, fishing expeditions into offshore accounts are explicitly permitted. The potential for abuse is obvious."

From: http://www.investorsoffshore.com/html/faq/faq_expat_tabletemp.html

"The Cayman Islands are one of the premier offshore financial centres, but have something of a reputation as a stereotypical 'tax haven' in Europe, although they have been attempting to guard against money laundering practices. It has to be said, however, that in the absence of proven wrongdoing, the emphasis is still firmly on preserving confidentiality. (Although this was dealt a blow by the judgment awarded in 2002 to the US Internal revenue Service in Miami, allowing them access to American Express and MasterCard records covering US citizens with offshore assets in the Caymans.)"

From: http://cayman.com.ky/banking.htm

"Advantages of a Cayman Islands Bank Account: No capital gains tax, Corporation Tax, withholding tax..."

Yet withholding tax is specifically stated in the "Official Guide To Investing In The Cayman Islands" http://www.investcayman.ky/forms/ci-investment-guide2005.pdf :

"Banks adhere to the ‘know your client’ rule. These rules have been approved by the U.S. Internal Revenue Service, enabling institutions in the Cayman Islands to become qualified intermediaries under the U.S. Withholding Tax Rules introduced on 1 January 2001."

From: http://www.alsea.org/forum/forum_posts.asp?TID=52

"Cayman Islands Bank Fails to Block IRS Discovery of Documents (Posted: 09 Nov 2006 at 7:23am) Cayman National Bank fails to quash an IRS summons seeking documents relating to a judgment obtained by the bank against a U.S. citizen. The court, in Cayman National Bank Ltd. v. United States , rejects arguments that discovery is barred by the attorney-client privilege, that IRS should have obtained discovery under the Tax Information Exchange Agreement between the United States and the United Kingdom, and that production would violate Cayman Islands law. Greg Cook, EA, CPA www.cookco.us"

On the phone with Cayman National Bank officer: "We will disclose your information if there is any court order to do so in the U.S."

Press release for TIEA between U.S. and Cayman Islands, except document is missing:

http://www.cimoney.com.ky/section/mediacentre/default.aspx?id=493

One location of same TIEA:

http://www.oecd.org/dataoecd/20/17/35514531.pdf

Government

The Cayman Islands are a British overseas territory, listed by the UN Special Committee of twenty-four as one of the last non-self governing territories. A fifteen-seat Legislative Assembly is elected by the people every four years to handle domestic affairs. Of the elected Members of the Legislative Assembly (MLAs), five are chosen to serve as government ministers in a cabinet headed by the governor. The head of government is the Leader of Government Business, which is currently The Honourable Kurt Tibbetts.

A Governor is appointed by the British government to represent the monarch. The governor can exercise complete executive authority if they wish through blanket powers reserved to them in the constitution. They must give royal assent to all legislation, which allows them the power to strike down any law the legislature may see fit for the country. In modern times, the governor usually allows the country to be run by the cabinet, and the civil service to be run by the Chief Secretary, who is the Acting Governor when the Governor is not able to discharge his usual duties for one reason or another. The current governor of the Cayman Islands is Stuart Jack and the current Chief Secretary is The Honourable George McCarthy, OBE, JP.^

Taxation

Caymanians and Caymanian companies are not subject to any form of direct taxation. However, an import tax of between 5% and 20% is levied on most imported goods. Import taxes on automobiles ranges from 27.5% to 40% for most vehicles while Hummers are taxed at 100% of their value.

Education

Primary and secondary schools

The Cayman Islands Education Department operates state schools. Caymanian children are entitled to free primary and secondary education. Various churches and private foundations operate several private schools that offer American and British based studies starting in nursery to Year 13.

Colleges and universities

Grand Cayman is home to University College of the Cayman Islands, the only government run University on the island. The University College is located at 168 Olympic Way in Georgetown, Grand Cayman. The International College of the Cayman Islands which is located in Newlands about seven miles (11 km) east of George Town. The college was established in 1970 and offers Associate's, Bachelor's and Post Graduate degree programmes. Grand Cayman is also home to St. Matthew's University, which includes a medical school and a school of veterinary medicine.

The Cayman Islands Law School (CILS), a branch of the University of Liverpool in the UK, is also based on Grand Cayman. Situated in George Town, the law school has been in operation since 1982. As taken from the student handbook, "The Law School provides tuition for both full and part-time programmes leading to the Bachelor of Law (Honours) Degree of the University of Liverpool and the qualification of Attorney-at-Law of the Cayman Islands, following successful completion of the postgraduate Professional Practicum Course (PPC)

The Cayman Islands Civil Service College, a unit of Cayman Islands government organised under the Portfolio of the Civil Service, is also located in Grand Cayman. Co-situated with University College of the Cayman Islands in a building on the south side of the campus, the intent of the CICSC is offer both degree programmes and continuing education units of various sorts. Further, the College is planned to develop as a government research centre. It opened in autumn 2007.

Health care

The Cayman Islands have a modern health care system. There are two hospitals in George Town, the government run George Town Hospital and the smaller, private Chrissie Tomlinson Memorial Hospital. Additionally, Faith Hospital is an eighteen-bed facility on Cayman Brac. The Government maintains a satellite clinic on Little Cayman.

Health insurance is handled by private insurers and a government-run company (CINICO). There is no universal health coverage as in the UK. All employers are required under Law to provide Health Insurance for their employees (although the employee may be required to contribute 50% of the premium). Full time employees also contribute USD 10 every month to the "Indigent Fund" which helps cover care for the unemployed, elderly etc.

Currently the islands lack facilities for cardiac catheterisation, though many feel the population is large enough to support the procedure. Various attempts to establish a cath lab in George Town Hospital have stalled. The Cayman Islands lacked an MRI after one was destroyed during Hurricane Ivan, but in July 2007 a new unit was installed at the Chrissie Tomlinson Memorial Hospital.

For divers and others in need of hyperbaric oxygen therapy, there is a two-person recompression chamber at George Town Hospital on Grand Cayman, run by Cayman Hyperbaric Services. The same organisation has built a hyperbaric unit at Faith Hospital in Cayman Brac, expected to be operational in January 2008.

Work permits

In order to work in the Cayman Islands as a non-citizen, a work permit is required. This involves passing a police background check and a health check. A prospective worker will not be granted a permit if certain medical conditions are present. Work permits are not issued after age 60.

The Cayman Islands presently imposes a controversial ["rollover"] policy in relation to expatriate workers who require a work permit. Non-Caymanians are only permitted to reside and work within the Territory for a maximum of seven years (non-renewable) unless they satisfy the criteria of key employees. The policy has been the subject of some controversy within the press, and concerns have been expressed that in the long term, the policy may damage the pre-eminence of the Cayman Islands as an offshore financial centre by making it difficult to recruit and retain experienced staff from onshore financial centres. Government employees are no longer exempt from this "rollover" policy according to this report in a local newspaper . The Governor has decided to use his constitutional powers, which give him absolute control for the disposition of civil service employees, to determine which expatriate civil servants are dismissed after seven years service and which are not.

This policy is enshrined in the Immigration Law (2003 revision), written by the UDP government, and subsequently enforced by the PPM government. Both governments agree to the term limits on foreign workers, and the majority of Caymanians also agree it is necessary to protect local culture, and heritage from being eroded by a large number of foreigners gaining residency/citizenship.

Military

The defence of the Cayman Islands is the responsibility of the United Kingdom. The Islands have their own police force, the Royal Cayman Islands Police Service. Regular off-shore marine patrols are conducted by the RCIP and Grand Cayman is a port of call for the United States Coast Guard.

Foreign relations

The foreign relations of the Cayman Islands are largely managed from the United Kingdom, as the islands remain an overseas territory of the UK. However, the Government of the Cayman Islands often resolves important issues with foreign governments alone, without intervention from Britain. Although in its early days, the Cayman Islands' most important relationships were with Britain and Jamaica, in recent years, a relationship with the United States has developed.

Though the Cayman Islands are involved in no major international disputes, they have come under some criticism due to the use of their territory for narcotics trafficking and money laundering. In an attempt to address this, the Government entered into the Narcotics Agreement of 1984 and the Mutual Legal Assistance Treaty of 1986 with the United States, in order to reduce the use of their facilities associated with these activities. In more recent years, they have stepped up the fight against money laundering, by limiting banking secrecy, introducing requirements for customer identification and record keeping, and requiring banks to cooperate with foreign investigators.

Due to their status as an overseas territory of the UK, the Cayman Islands have no representation either on the United Nations, or in most other international organisations. However, the Cayman Islands still participates in some international organisations, being a full member of the Central Development Bank, and an associate member of Caricom and UNESCO, and a member of a sub-bureau of Interpol.

Sport

The Cayman Islands are members of FIFA, the International Olympic Committee and the Pan American Sports Organisation, and also compete in the biannual Island Games.