Entering service in the Russian Air Force from 2014, the Su-34 is widely considered the most capable strike fighter in service anywhere in the world. The aircraft was designed as a replacement for and successor to the highly successful Su-24M strike platform which was develop for the Soviet military and is used by eight countries today. The Su-34 is the heaviest fighter in the world, with the only heavier combat jets being bombers and Russia’s MiG-31 Foxhound heavy interceptors, but its cost has been relatively low despite its weight with the aircraft being cheaper than Russian jets built for air to air combat such as the Su-35 and Su-57. Despite having received no export orders, the fighter is being produced on a considerably scale with over 140 currently in service and close to 100 more expected to join the Russian Air Force and Navy at a conservative estimate. The design has continued to be improved over time, most recently with the entry into production of the Su-34M enhanced variant which which according to the director general of Russia’s United Aircraft Corporation Yuri Slyusar has double the combat capacity of the original Su-34.

The Russian Defence Ministry reportedly ordered two full regiments of the Su-34M in May 2020, and the new variants come equipped with a dedicated interface for three different types of sensors for improved situational awareness. These include the UKR-RT pod which carries electronic search measures, the UKR-OE is a camera pod and the UKR-RL which integrates a synthetic aperture radar. The Su-34M also reportedly improves on the air to air capabilities of the original Su-34, which unlike the Su-24M is capable of effectively deploying both long and short range radar guided air to air missiles such as the R-27 and R-77. This defensive air to air capability means the Su-34 is much less heavily reliant on a fighter escort than the Su-24 was. This not only makes it a more useful platform for the Russian Military, but also makes it potentially more attractive to smaller air forces for export which would struggle to effectively field an aircraft that is extremely specialised and lacks any air to air capability as the Su-24M did. Although demand for dedicated long range strike aircraft has generally been limited overseas, as multirole aircraft with less specialisation have been more popular such as the Su-30SM, the Su-34 and particularly the new Su-34M variant still have a not insignificant export potential. A look at the leading potential clients for the Su-34M is given below:

Algeria

The Algerian Air Force has shown an interest in the Su-34 since before it entered service in the Russian Air Force itself, with unconfirmed reports indicating that an order for 14 fighters may have already been made. Algeria is currently by far the largest foreign operator of the Su-24 with three squadrons in service between them fielding 36 aircraft, with the Su-34 considered the natural successor. The Su-34’s much higher endurance is likely to be particularly highly prized due to both the vastness of Algerian territory, as the largest country in Africa, as well as the need to reach targets overseas including in Europe for possible retaliatory strikes. Unconfirmed reports indicate that a sticking point in negotiations for an Algerian acquisition was that Russia only offered a heavily downgraded variant of the Su-34 for export, due to the aircraft’s sensitivity, which did not meet the requirements of the Algerian Air Force. It remains uncertain whether, should Algeria acquire the fighter, it would replace all Su-24 units with the new aircraft or reduce its fleet of dedicated strike aircraft to replace some with a more balanced multirole fighters such as the Su-30 or Su-57. The former currently forms the backbone of the Algerian Air Force, while Algeria is widely expected to become the world’s first export client for the latter.

Vietnam

The Vietnamese People’s Air Force is expected to see considerable investment in the 2020s to replace many of the combat aircraft currently in service, with local media outlets having repeatedly stated that acquisitions of Su-57 fighter jets were being planned likely to replace the country’s Su-27 Flanker air superiority fighters acquired from the 1990s. The country’s fleet of combat jets is currently comprised of seven regiments, including two of Su-27s, two of relatively modern Su-30MK2s which are expected to serve into the 2030s, and three dedicated strike fighter squadrons comprised of lighter Su-22M3, Su-22M4 and Su-22UM fighters delivered by the Soviet Union in the late 1980s. Although the Su-22 is a relatively old airframe design, it benefits from low operational costs and its avionics remain relatively advanced and well suited to precision strike and maritime strike roles. After providing Vietnam with hundreds of third generation fighter jets from the late 1970s, including 180 MiG-21s and several Su-22s, the Soviet Union in the late 1980s delivered the much more sophisticated Su-22M4 which was seen to comfortably provide maritime air supremacy particularly against China and Thailand. These aircraft are expected to be replaced by longer ranged more modern jets in the near future, with their successors having been widely speculated and the Russian Su-30SM and American F-16 Block 70/72 both being considered possibilities. Should the Air Force seek to maintain dedicated strike regiments, however, and intend to maximise their range with very high endurance aircraft for operations over the expanses of the South China Sea, the Su-34 may be the most suitable option and would be the most natural successor to the Su-22. With U.S. restrictions on the uses of its fighters making an F-16 acquisition less likely, and the Su-30SM being marketed at a similar cost, there is a not insignificant chance that the Su-34 will be selected.

Syria

The Syrian Arab Air Force acquired its first Su-24 strike fighters from the Soviet Union in 1990, with 22 Su-24MK jets delivered followed by two more airframes as aid from Libya in the 1990s. Based at T4 Airbase in Central Syria, the strike fighters played an important role in Syria’s plans to develop a viable asymmetric deterrent force which could ensure the country’s sovereignty without support from the Soviet Union and in the face of deteriorating capabilities on land and in the air. The aircraft were modernised to the Su-24M2 standard from 2010, improving availability, maintainability and combat effectiveness, with continued funding despite a post-2011 strain on the economy from the ongoing insurgency reflecting the continued importance attributed to the squadron. The value Damascus saw in a relatively long range precision strike capability was perhaps best demonstrated in 2013, when in the face of British, French, Turkish and U.S. threats to attack the country the Syrian Air Force flew Su-24s over the Mediterranean Sea to simulate strikes on British military facilities in Cyprus, demonstrating an ability to retaliate with assets other than its considerable ballistic missile arsenal. Su-24s were also used to extensively probe Turkish defences that year.

Should Syria’s economy stabilise, with support of significant aid from non-Western countries such as China and Iran and military support from Russia, the country could seek to invest in its air force in future. An eventual upgrade to the Syrian strike fleet remains possible in the late 2020s or early 2030s, either with further improved Su-24s acquired second hand from Russia or with Su-34s possibly purchased second hand from the Russian Air Force. The fighter is relatively affordable with a lower operational cost than the Su-24, and Syrian forces have had considerable experience operating alongside them. While Russia has come under pressure from Israel to refrain from providing Syria with anti-aircraft systems or ballistic missiles, this would likely not apply to strike fighters which are aimed mainly at Syria’s NATO adversaries. Furthermore, with Russia having invested heavily in Syria’s security, providing Su-34s at friendly prices much as it previously provided MiG-29 fighters and S-300 air defence systems as outright aid could be seen as a means to reduce the burden on the Russian military itself, while also increasing interoperability with Russian Air Force units based in western Syria.

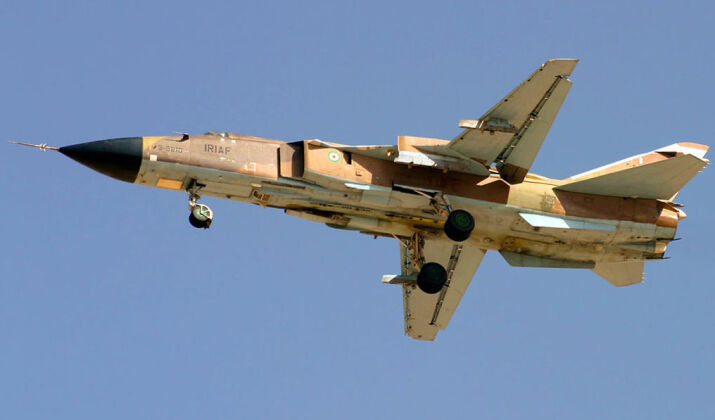

Iran

The Iranian Air Force is currently a significant operator of Soviet strike fighters with approximately 30 Su-24M and 15 Su-22s currently in service all of which could be slated for replacement in the 2020s, with the UN arms embargo on the country having expired in October 2020. The Su-34 could be acquired to replace both aircraft, as well as multirole fighters such as F-4E Phantoms which have long been allocated strike roles. Iran’s lack of high endurance strike fighters was previously a major issue encountered during the Iran-Iraq War, before it had acquired Soviet fighters, leading it to modify its F-14 Tomcat heavyweight interceptors to carry air-to-ground ordinance. Whether Iran would consider acquiring the Su-34 depends largely on the state of its current fleet and the extent to which it is in need of retirement, as well as the position of its economy over the next decade. The country has many alternatives to a Su-34 acquisition, however, which could be more attractive including reliance on its indigenous and demonstrably highly potent stealth drones such as the Shahed 191 which may well be seen as both more cost effective and more survivable. Iran’s emergence as a world leader in ballistic missile capabilities has also brought the need for manned dedicated strike aircraft increasingly into question.

Angola

The Angolan Air Force is the leading operator of Russian heavyweight fighters in sub-saharan Africa, having acquired a unit each of Su-24M and Su-22 strike fighters alongside multirole Su-30K jets which are well armed for strike operations. The age of many of these assets has raised the possibility that Angola could acquire new strike aircraft in the coming decade, although a number of factors mean that it is less likely than other clients to consider such a deal. The Angolan fighter fleet saw its birth during times of high tensions with neighbouring South Africa, and with the country at peace with its neighbours the impetus for further acquisitions has faded. Furthermore, while in the Cold War era dedicated strike aircraft were popular due to the more limited air to ground capabilities of multirole aircraft, improvements in multirole platforms such as the Su-30 have reduced interest in acquiring strike fighters. Angola’s placing of much of its strike fleet in storage is an indicator that its interest in such assets, if any, will be limited.

North Korea

Currently under a Untied Nations arms embargo, any North Korean fighter imports for the foreseeable future will need to be of aircraft classes which it already operates so as to avoid exposing its supplier’s violation of the embargo. Thus while continued Russian MiG-29 sales to its eastern neighbour have been speculated, sales of a new fighter class, particularly one as radical as the Su-34, are effectively impossible. Nevertheless, should the arms embargo be lifted or should the current UN system break down, there is a significant possibility that North Korea would show a strong interest in the Su-34. The country continues to operate Il-28 long range strike aircraft in considerable numbers, although these have for decades been considered obsolete despite domestic improvements to their armaments. Reports in the early 2000s indicated that a sale of Su-24M strike fighters was being discussed to replace these older jets, although Russia was reportedly reluctant at the time in part due to the need to maintain good relations with South Korea and the United States. With Russian-U.S. relations having since deteriorated, however, Russia could well consider a sale, and North Korea consider a purchase, should the obstacle of an arms embargo be removed. The Su-34 would provide an effective complement to North Korea’s ballistic missile arsenal, and provide a means of threatening American targets far afield including carrier groups and bases in Okinawa with the fighter’s standoff weapons. North Korea may well be the most willing of all prospective clients to make such an acquisition.