Minimum wage

2008/9 Schools Wikipedia Selection. Related subjects: Economics

A minimum wage is the lowest hourly, daily or monthly wage that employers may legally pay to employees or workers. First enacted in Australia and New Zealand in the late nineteenth century, minimum wage laws are now in force in more than 90% of all countries.

Many supporters of the minimum wage assert that it is a matter of ethics and social justice that helps reduce exploitation and ensures workers can afford what are considered to be basic necessities. Among some American economists opinions of the minimum wage tend to be less favorable. A 2000 survey by Dan Fuller and Doris Geide-Stevenson reports that of a sample of 308 American Economic Association economists, 45.6% fully agreed with the statement, "a minimum wage increases unemployment among young and unskilled workers", 27.9% partially agreed, and 26.5% disagreed.

History

The history of minimum wage laws begins in 1896, when New Zealand established arbitration boards with the Industrial Conciliation and Arbitration Act. Also in 1896 in Victoria, Australia, an amendment to the Factories Act provided for the creation of a wages board. The wages board did not set a universal minimum wage, but set basic wages for six industries that were considered to pay low wages.. First enacted as a four-year experiment, the wages board was renewed in 1900 and made permanent in 1904. By that time it covered 150 different industries. By 1902, other Australian states, such as New South Wales and Western Australia, had also formed wages boards.

In 1907, the Harvester decision was handed down in Australia. It established a 'living wage' for a man, his wife and two children to "live in frugal comfort." In 1907 Ernest Aves was sent by the British Secretary of State for the Home Department to investigate the results of the minimum wage laws in Australia and New Zealand. In part as a result of his report, Winston Churchill, then president of the Board of Trade, introduced the Trade Boards Act on March 24, 1909. It became law in October of that year, and went into effect in January of 1910. In 1912, the state of Massachusetts, United States, set minimum wages for women and children. In the United States, statutory minimum wages were first introduced nationally in 1938. In addition to the federal minimum wage, nearly all states within the United States have their own minimum wage laws with the exception of South Carolina, Tennessee, Alabama, Mississippi and Louisiana. In the 1960s, minimum wage laws were introduced into Latin America as part of the Alliance for Progress; however these minimum wages were, and are, low.

Minimum wage law

Minimum wage laws vary greatly across many different jurisdictions, not only in setting a particular amount of money (e.g. US$5.85 per hour under U.S. Federal law, or £5.52 (for those aged 22+) in the United Kingdom), but also in terms of which pay period (e.g. Russia and China set monthly minimums) or the scope of coverage. For instance, not all workers may be paid a full minimum wage, because exceptions may be made for teenagers or those under 21. Some jurisdictions allow employers to count tips given to their workers as credit towards the minimum wage level.

Europe

- See also: National Minimum Wage Act 1998 for UK

In the European Union, 20 out of 27 member states currently have national minimum wages. Some countries, such as Norway, Sweden, Finland, Denmark, Switzerland, Germany, Austria, Italy, and Cyprus have no minimum wage laws, but rely on employer groups and trade unions to set minimum earnings through collective bargaining.

North America

Australia

A 2005 study found that the Australian federal minimum wage was 58% of the median wage, compared to 45% in Britain and 34% in the USA. The typical minimum wage worker is in a middle-income household.

In Australia, on 14 December 2005, the Australian Fair Pay Commission was established under the Workplace Relations Amendment ( WorkChoices) Act 2005. It is the responsibility of the commission to adjust the standard federal minimum wage, replacing the role of the Australian Industrial Relations Commission that took submissions from a variety of sources to determine appropriate minimum wages. As of 2007, the minimum wage is AUD$13.74 per hour or AUD$522.12 per week.

Minimum wage economics

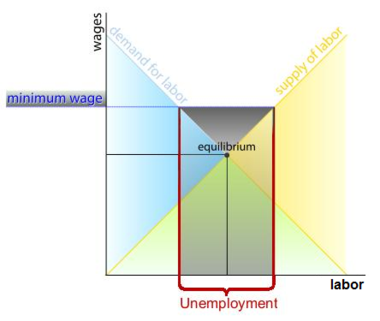

Economic theory analyzes the effects of minimum wages within the context of labor markets (c.f. labor economics). In a labor market, workers supply their labor, which is sold for wages, and employers demand labor.

The traditional economic argument views the labor market as perfectly competitive. In perfectly competitive markets, the market price settles to the marginal value of the product. Therefore, under the perfect competition assumption, absent a minimum wage, workers are paid their marginal value. As is the case with all (binding) price floors above the equilibrium, minimum wage laws are predicted to result in more people being willing to offer their labor for hire, but fewer employers wishing to hire labor. The result is a surplus of labor, or, in this case, unemployment.

Supply of labor curve

The amount of labor that workers supply is generally considered to be positively related to the nominal wage; as wage increases, labor supplied increases. Economists graph this relationship with the wage on the vertical axis and the quantity of labor supplied on the horizontal axis. The supply of labor curve then is upward sloping, and is depicted as a line moving up and to the right.

The upward sloping labor supply curve results from the fact that, as wages rise, people in the labor force are incented to spend less time in leisure and more time working while people outside the labor force are incented to join the labor force. As wages rise, the cost of spending time in leisure and the cost of not being a labor force participant rises.

Demand for labor curve

The amount of labor demanded by firms is generally assumed to be negatively related to the nominal wage; as wages increase, firms demand less labor. As with the supply of labor curve, this relationship is often depicted on a graph with wages represented on the vertical axis, and the quantity of labor demanded on the horizontal axis. The demand for labor curve is downward sloping, and is depicted as a line moving down and to the right on a graph.

A firm's cost is a function of the wage rate. As the wage rate rises, it becomes more expensive for firms to hire workers and so firms hire fewer workers.

Supply and demand for labor

Combining the demand and supply curves for labor allows us to examine the effect of a minimum wage.

The point at which the demand for labor curve and the supply of labor curve intersect is the labor market equilibrium. At the equilibrium, the number of people seeking jobs (the quantity supplied of labor) equals the number of jobs available (the quantity demanded of labor). If the wage rate rises above the equilibrium wage, then the number of people seeking jobs will exceed the number of jobs available. This is unemployment.

In the absence of government intervention, competition among workers for the limited number of jobs would cause wages to fall until the wage rate reached the equilibrium and the unemployment was eliminated. A minimum wage prevents wages from falling and so the unemployment remains.

Standard theory criticism

Gary Fields, Professor of Labor Economics and Economics at Cornell University, argues that the standard "textbook model" for the minimum wage is "ambiguous", and that the standard theoretical arguments incorrectly measure only a one-sector market. Fields says a two-sector market, where "the self-employed, service workers, and farm workers are typically excluded from minimum-wage coverage… [and with] one sector with minimum-wage coverage and the other without it [and possible mobility between the two]," is the basis for better analysis. Through this model, Fields shows the typical theoretical argument to be ambiguous and says "the predictions derived from the textbook model definitely do not carry over to the two-sector case. Therefore, since a non-covered sector exists nearly everywhere, the predictions of the textbook model simply cannot be relied on."

An alternate view of the labor market has low-wage labor markets characterized as monopsonistic competition wherein buyers (employers) have significantly more market power than do sellers (workers). Such a case is a type of market failure and results in workers being paid less than their marginal value. Under the monopsonistic assumption, an appropriately set minimum wage could increase both wages and employment, with the optimal level being equal to the marginal productivity of labor. This view emphasizes the role of minimum wages as a market regulation policy akin to antitrust policies, as opposed to an illusory " free lunch" for low-wage workers. Detractors point out that no collusion between employers to keep wages low has ever been demonstrated, asserting that in most labor markets, demand meets supply, and it is only minimum wage laws and other market interference which cause the imbalance. However collusion is not a pre-requisite for market power; segmented markets, information costs, imperfect mobility and the 'personal' element of labor markets all represent movements away from the idealized perfectly competitive labor market.

Debate

On an episode of the British political tv show, Question Time in 1994, the then Secretary of State for Trade, Michael Heseltine (Conservative) and the deputy leader of the opposition John Prescott (Labour) were engaged in a heated debate about Labour's proposals to introduce a National Minimum Wage. This brings out many of the key points,

Prescott: Why is it always millionaires like yourself that get uptight about £2 an hour more for people on minimum?

Heseltine: I'll tell you, I'll tell you. Because I know something about actually creating jobs as opposed to just talking about them.

P: You've done a lot better than your workers then.

H: And created a large number of jobs in the process.

P: Not at £2 an hour.

H: Now you just tell the people of this country...

P: Is £2 an hour acceptable to you?

H: You know perfectly well that what you're talking about is £4.08 an hour as the minimum wage.

P: Is £2 an hour acceptable to you as a very wealthy man?

H: It is nothing to do with me being a wealthy man.

P: Is it acceptable, £2 an hour?

H: It is entirely a matter of what people are prepared to accept in the circumstances of getting a job.

Supporters of the minimum wage claim it has these effects:

|

Opponents of the minimum wage claim it has these effects:

|

Debate over consequences

A classical economics analysis of supply and demand implies that by mandating a price floor above the equilibrium wage, minimum wage laws should cause unemployment. This is because a greater number of workers are willing to work at the higher wage while a smaller numbers of jobs will be available at the higher wage. Companies can be more selective in those whom they employ thus the least skilled and inexperienced will typically be excluded.

However, there are many other variables that can complicate the issue such as monopsony in the labour market, whereby the individual employer has some market power in determining wages paid. Thus it is at least theoretically possible that the minimum wage may boost employment. Though single employer market power is unlikely to exist in most labour markets in the sense of the traditional ' company town,' asymmetric information, imperfect mobility, and the 'personal' element of the labour transaction give some degree of wage-setting power to most firms.

Economists disagree as to the measurable impact of minimum wages in the 'real world'. This disagreement usually takes the form of competing empirical tests of the elasticities of demand and supply in labor markets and the degree to which markets differ from the efficiency that models of perfect competition predict.

A 2000 survey by Dan Fuller and Doris Geide-Stevenson reports that of a sample of 308 American Economic Association economists, 45.6% fully agreed with the statement, "a minimum wage increases unemployment among young and unskilled workers", 27.9% agreed with provisos, and 26.5% disagreed. The authors of this study also reweighted data from a 1990 sample to show that at that time 62.4% of academic economists agreed with the statement above, while 19.5% agreed with provisos and 17.5% disagreed.

A similar survey in 2006 by Robert Whaples polled PhD members of the American Economic Association. Whaples found that 37.7% of respondants supported an increase in the minimum wage while 46.8% wanted it completely eliminated.

In the debate about minimum wage it is rarely mentioned by how much the quantity of labor demanded may fall if the minimum wage is raised. Research papers by the Employment Policies Institute and by the National Centre for Policy Analysis claim that increases of 10% in the minimum wage may reduce demand hours worked at the minimum wage by around 1% or 2% depending on circumstances.

Some research suggests that the unemployment effects of small minimum wage increases are dominated by other factors. In Florida, where voters approved an increase in 2004, a follow-up comprehensive study confirms a strong economy with increased employment above previous years in Florida and better than in the U.S. as a whole. : “The Florida Minimum Wage After One Year.” http://www.risep-fiu.org/reports/Florida_Minimum_Wage_Report.pdf

According to a claim by the Mackinac Centre for Public Policy, the passage of the first Federal mandated minimum wage in the United States in 1938 led to an estimated 500,000 blacks losing their jobs via replacement by higher skilled and more educated white laborers. Milton Friedman, 1976 Nobel Prize winner in Economics, called the minimum wage one of the most "anti-negro laws" for what he saw as its adverse effect on black employment.

Today, the International Labour Organization (ILO) and the OECD do not consider that the minimum wage can be directly linked to unemployment in countries which have suffered job losses. Although strongly opposed by both the business community and the Conservative Party when introduced in 1999, the minimum wage introduced in the UK is no longer controversial and the Conservatives reversed their opposition in 2000. A review of its effects found no discernible impact on pay levels.

Minimum wage alternatives

Some critics of the minimum wage argue that a negative income tax or earned income tax credit benefits a broader population of low wage earners, and society as a whole bears the cost. In this view, this is more economically efficient because a low tax rate on the broader economy causes less deadweight loss than a high tax rate on a small section of the economy. The ability of the earned income tax credit to deliver a larger monetary benefit to poor workers at a lower cost to society was recently documented in a report by the Congressional Budget Office.